Document Market Protection in 2024: A Banner 12 months for Protection | CEA

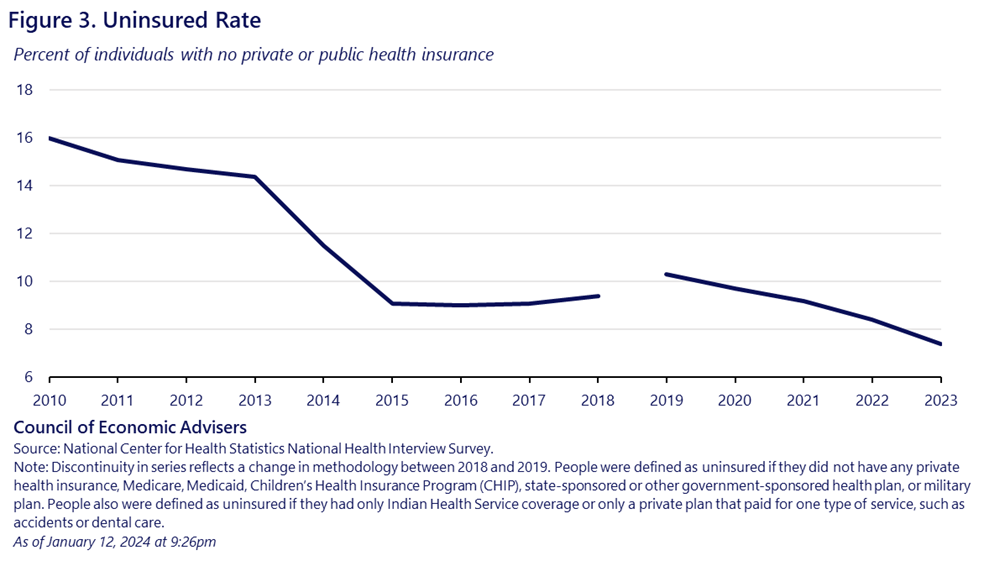

Final week, the Inexpensive Care Act’s (ACA) Well being Insurance coverage Market open enrollment interval (throughout which people and small teams can store for 2024 protection) closed. Enrollment reached over 21 million for the 2024 plan 12 months—a document excessive because the launch of the ACA Marketplaces a decade earlier. This pattern has occurred within the context of an general enhance in medical health insurance protection in recent times, together with a decline within the uninsured charge—from 16 % in 2010, previous to ACA implementation, to 7.2 percent in the newest knowledge. Well being protection, together with public protection, is necessary for monetary safety, dramatically improves health outcomes, and has wide-ranging and long-term advantages for kids. On this weblog, we spotlight the coverage selections that led to 3 consecutive years of record-breaking Market enrollment, and place this pattern within the broader context of insurance coverage protection tendencies general, together with modifications in Medicaid enrollment and traditionally low charges of individuals with out insurance coverage.

Final week, the Inexpensive Care Act’s (ACA) Well being Insurance coverage Market open enrollment interval (throughout which people and small teams can store for 2024 protection) closed. Enrollment reached over 21 million for the 2024 plan 12 months—a document excessive because the launch of the ACA Marketplaces a decade earlier. This pattern has occurred within the context of an general enhance in medical health insurance protection in recent times, together with a decline within the uninsured charge—from 16 % in 2010, previous to ACA implementation, to 7.2 percent in the newest knowledge. Well being protection, together with public protection, is necessary for monetary safety, dramatically improves health outcomes, and has wide-ranging and long-term advantages for kids. On this weblog, we spotlight the coverage selections that led to 3 consecutive years of record-breaking Market enrollment, and place this pattern within the broader context of insurance coverage protection tendencies general, together with modifications in Medicaid enrollment and traditionally low charges of individuals with out insurance coverage.

After an preliminary ramp up in 2014–2016, ACA Market enrollment had hovered round 12 million by means of 2021 earlier than surging in 2022, 2023, and 2024. What accounts for the key good points in Market enrollment, relative to the prior 4 years? In keeping with its unsuccessful efforts to repeal Obamacare wholesale, the prior Administration took quite a lot of administrative and regulatory steps supposed to undermine ACA Marketplaces, together with increasing the provision of junk plans (that supplied shoppers with decrease high quality protection and disrupted the markets) and reversing investments in enrollment assistance and consumer outreach.

The Biden Administration has taken a number of necessary actions that collectively have contributed to the renewed power of Marketplaces, taking enrollment from 12 million in 2021 to 21.3 million at the moment (see Determine 1). Most importantly, to handle client costs, the American Rescue Plan (ARP) and the Inflation Reduction Act (IRA) signed by President Biden expanded and prolonged the superior, refundable tax credit that assist People buy Market insurance coverage. These legal guidelines prolonged the credit to households above 400 % of the Federal Poverty Line—$120,000 for a household of 4 in 2023—whereas making the credit extra beneficiant and decreasing premiums considerably for folks at decrease earnings ranges, with premium savings averaging $800 per individual per 12 months. Past tax credit, the Administration has taken a bunch of actions to assist shoppers looking for Market plans, together with fixing the family glitch (the place being supplied an unaffordable household plan by an employer restricted the assistance out there to buy a Market household plan). The Administration elevated funding for the Navigator program to assist shoppers finds plans that match them greatest and expanded investments in broad promoting and outreach efforts. Lastly, the Administration eradicated pointless paperwork obstacles that made it tougher to enroll in or preserve protection and made it attainable for low-income shoppers and people transitioning out of Medicaid to join protection all year long.

Transitions from Medicaid?

Some analysis has famous that the document 2024 Market enrollment might be pushed partly by unwinding of the pandemic-era Medicaid steady protection guidelines. So how a lot of the 2024 plan-year surge within the Marketplaces is because of disenrollment from Medicaid in current months?

For 3 years starting April 2020, the Households First Coronavirus Response Act (FFCRA) suspended the traditional renewal course of that may in any other case result in the traditional churn and disenrollment of some Medicaid enrollees every month. In April 2023, when this steady enrollment situation expired and the short-term coverage started to unwind, regular eligibility renewal and disenrollment processes by state Medicaid companies resumed. Since then, Medicaid enrollment has been declining.

Unwinding possible does clarify a number of the progress from 2023 to 2024. The ACA Marketplaces are an necessary supply of protection for people who find themselves exiting Medicaid as a result of their earnings has risen: the ACA was designed to facilitate these sorts of transitions and some states have taken actions to make these transitions simpler.[1] Atypically excessive mid-year growth in 2023 Market enrollment (previous to open enrollment) is per transitions from Medicaid to Market protection.

However, Medicaid unwinding can’t clarify many of the Market progress since 2020, particularly as a result of a lot of that progress predates unwinding. Determine 1 exhibits that Market enrollment grew year-over-year for every of the 2021, 2022, and 2023 open enrollment intervals—earlier than Medicaid unwinding started in April 2023.

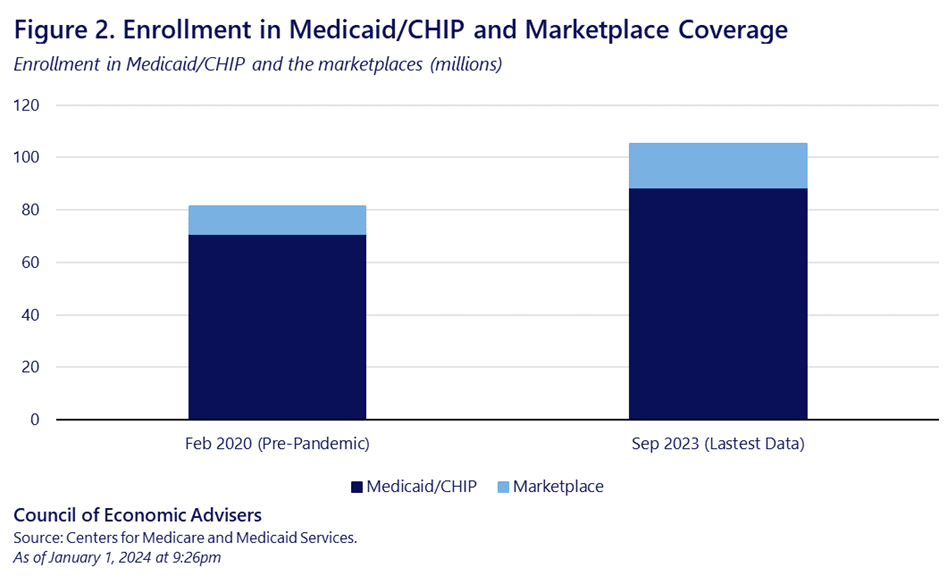

At this time, enrollment stays larger in each Medicaid and the ACA Marketplaces than in 2020, previous to the COVID public well being emergency. In essentially the most recent available data from September 2023, Medicaid enrollment was about 88.5 million, in comparison with nearly 71 million in February 2020, previous to the continual protection guidelines carried out in 2020. Which means that Medicaid enrollment stays above its pre-pandemic pattern progress over the 2017-2020 interval.[2] Combining the most recent out there Medicaid knowledge (September 2023) with Market enrollment from the identical time yields an combination 105 million, considerably larger than the mixed whole of 81.4 million in February 2020. Thus, even a half-year into Medicaid unwinding, the variety of People remaining insured by means of one in all these two channels was considerably larger (see Determine 2) than pre-pandemic. As an entire, the proof means that we are actually seeing one thing nearer to the complete impact of the Biden Administration’s insurance policies to strengthen Market protection choices, which beforehand had been partially masked by unusually excessive Medicaid enrollment as a result of COVID-era steady protection provisions.

Robust Open Enrollment Ought to Assist Maintain Historic Protection Features

Lastly, the uninsured charge (the share of individuals with no medical health insurance protection over the complete 12 months) has been at document lows. The newest whole-year survey knowledge from the Present Inhabitants Survey, which covers by means of finish of plan 12 months 2022, positioned the uninsured charge on the historic low of 7.9 percent. These knowledge are constant with other sources, together with the Nationwide Well being Interview Survey (NHIS) and the American Neighborhood Survey. Newer partial-year data and CBO projections point out that the uninsured charge in 2023 was even decrease than in 2022, setting a brand new document for insurance coverage protection charges. Determine 3 exhibits the pattern in NHIS knowledge, going again to 2010, earlier than the key provisions of the ACA had been carried out and induced a fast decline within the uninsured charge.

Whereas the Determine 3 knowledge predate the 2024 open enrollment interval, historic sign-ups for 2024 ACA protection ought to assist maintain protection good points, even with the modifications related to the tip of the Medicaid steady protection provision. In sum, current protection tendencies are per the conclusion that Biden Administration actions have led to better Market enrollment and contributed to an general enhance in insurance coverage protection to document ranges.

[1] Efforts embrace reducing purple tape for these transitioning out of Medicaid, and mechanically enrolling former Medicaid beneficiaries into zero premium Market plans for which they're eligible.

[2] January 2017 Medicaid enrollment was 76.1 million. In January 2020 it was 74.7 million.

Post a Comment for "Document Market Protection in 2024: A Banner 12 months for Protection | CEA"